Tax credits for individuals: What they mean and how they can ...

Jan 27, 2025 · A tax credit is a dollar-for-dollar amount taxpayers claim on their tax return to reduce the income tax they owe. Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund. Some tax credits are refundable.

Tax Credit: What It Is, How It Works, What Qualifies, 3 Types

Nov 1, 2024 · What Is a Tax Credit? The term “tax credit” refers to an amount of money that taxpayers can subtract directly from the taxes they owe. This is different from tax...

What Is a Tax Credit? How They Work, Common Types & More ...

Jan 17, 2025 · One way is to take advantage of any tax credits available to you. If you're more familiar with tax deductions, you may wonder: What is a tax credit, exactly? Here's a closer look at what these credits are and how some of the more common federal tax credits work.

Credits and deductions for individuals - Internal Revenue Service

Jan 16, 2025 · A credit is an amount you subtract from the tax you owe. This can lower your tax payment or increase your refund. Some credits are refundable — they can give you money back even if you don't owe any tax. To claim credits, answer questions in your tax filing software. If you file a paper return, you’ll need to complete a form and attach it.

Federal tax credit: How it works, difference from deduction

Dec 31, 2024 · What is a federal tax credit? Broadly speaking, a tax credit is the dollar-for-dollar amount of money that taxpayers subtract directly from the income taxes they...

What Are Tax Credits? - TurboTax Tax Tips & Videos

Oct 16, 2024 · How do tax credits work? A tax credit is a dollar-for-dollar reduction in your income. For example, if your total tax on your return is $1,000 but you are eligible for a $1,000 tax credit, your net liability drops to zero.

What is a Tax Credit? How It Works and How to Claim It

Mar 9, 2021 · How does a tax credit work? Let’s say you owe $2,000 for federal income taxes and you claim a $1,000 tax credit. The tax credit reduces your tax bill dollar for dollar.

What Is a Tax Credit? | Benefits and How They Work

Dec 9, 2024 · Tax credits directly lower your tax bill, making them more valuable than tax deductions. Some tax credits are refundable or can be carried forward to future years. You can get tax...

Understanding Tax Credits: Types, Calculations, and Effects

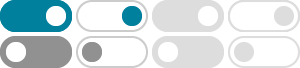

Jan 18, 2025 · Common Tax Credit Misconceptions. Misunderstandings about tax credits can lead to missed opportunities or compliance issues. A common misconception is that all tax credits are refundable. Knowing the differences between nonrefundable, refundable, and partially refundable credits is essential to avoid unexpected tax bills or smaller refunds.

What are tax credits and how do they differ from tax ...

Tax credits are subtracted directly from a person’s tax liability; they therefore reduce taxes dollar for dollar. Credits have the same value for everyone who can claim their full value. Most tax credits are nonrefundable; that is, they cannot reduce a filer’s income tax liability below zero.